how much taxes should be withheld

You can have 10 in federal taxes withheld directly from your pension and IRA distribution so that you would receive a net 18000 from your pension and 27000 from your IRA. How do I.

The average tax rate for taxpayers who earn over 1000000 is 331 percent.

. If you employ working holiday makers other tax tables apply. Employers calculate withholding tax by referring to an employees Form W-4 and the IRSs income tax withholding table to determine how much federal income taxes they should. All of your annual taxable wages are subject to this tax. Where payroll tax refers just to employer-withheld income tax it is sometimes called Pay as You Go For example in California employers need to withhold both disability insurance and family paid leave contributions.

How much tax is in a dollar. For information about other changes for the 202122 income year refer to Tax tables. When To Change How Much Tax Is Withheld From Your Pension When you are working you can change the amount of tax withheld from your paycheck each year. An employee required to have 08 deducted may elect to increase this rate to 13 18 27 36 42 or 51 by submitting a Form A-4.

The easiest and quickest way to work out how much tax to withhold is to use our online tax withheld calculator. People with more complex tax situations should use the instructions in Publication 505 Tax Withholding and Estimated Tax. When you take 401k distributions and have the money sent directly to you the service provider is required to withhold 20 for federal income tax. Ad Award Winning US.

This Tax Withholding Estimator works for most taxpayers. Your employer pays the same amount as. The reason the default withholding rate is 10 though is that its generally a pretty good measure of the eventual tax liability that a typical taxpayer will. What percentage of my paycheck should be withheld for federal taxes.

How much taxes do they take out of a 900 dollar check. Take your annual tax withholding and subtract your estimated tax liability. Their after-tax cash flow available will be 97988. The tax rate is calculated by dividing the total federal taxes owed by the total taxable income.

For 2015 your employer withholds Social Security tax at 62 percent of your taxable wages up to 118000 for the year. What percentage of taxes do I pay. Have 11 in federal taxes withheld from their pension and IRA distributions. The percentage of withholding is determined by the employees tax bracket.

You may owe some money at the time you file your return but it shouldnt be much. Our Tax Planning Services for Retirees. 0765 for a total of 11475. What percentage of federal tax is withheld.

Or make quarterly tax payments of 1962. Next Calculate the Tax Withholding Rate To estimate their needed tax withholding at age 73 take 7847 divided by the total of their pension and IRA income of 71255 and the result is 11. 62 Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. The ATOs tax withheld calculator applies to payments made in the 202122 income year.

How Much Should I Withhold From My Employees Wages. Here are Sam and Saras options for tax withholding. Calculating amount to withhold. Do so in early 2022 before filing your federal tax return to ensure the right amount is being withheld.

For those who make between 10000 and 20000 the average total tax rate is 04 percent. The 15000 annual wages threshold has been removed. How Much Should I Withhold For Taxes 1099. 30 Minutes to File.

Total federal taxes owed will be about 7847. What is the federal tax rate for 2021. 30 Minutes to File. 2022 Payroll Tax and Paycheck Calculator for all 50 states and US territories.

Find Your Adjusted Gross Income AGI If youre changing your tax withholding youll need to know your adjusted gross income AGI. The percentage of tax withheld from your paycheck depends on what bracket your income falls in. The federal withholding tax has seven rates for 2021. Once you have an idea of how much you owe the IRS its time to compare that amount to your total withholding.

If they want no taxes withheld from the pension they could have 37 federal taxes withheld when they take their IRA withdrawal. This all depends on whether youre filing as single married jointly or married separately or head of household. The amount that should be withheld is based on the employees tax rate. When determining the correct withholding amount for your salary or wages your objective should be to have just enough taxes withheld to prevent you from incurring penalties when your tax return is due.

These take into account the Medicare levy study and training support loans and tax-free threshold. The employee can submit a Form A-4 for a minimum withholding of 08 of the amount withheld for state income tax. Small businesses need to calculate withholding tax to know how much money they should take from employee paychecks to send to the Internal Revenue Service to cover tax payments. This includes taxpayers who owe alternative minimum tax or certain other taxes and people with long-term capital gains or qualified dividends.

How much should I save for taxes w2. Alternatively you can use the range of tax tables we produce. How much is tax usually. How much federal tax should be withheld from 401k distribution.

Lets continue our example from above and assume your estimated tax liability is 9600. 10 12 22 24 32 35 and 37. How much taxes do you pay on 1000. For example for 2021 if youre single and making between 40126 and 85525 then you are responsible for paying 22 percent of your income in taxes to the federal government.

You can find your AGI number on your prior years tax return. What are the tax brackets for 2020. For the employee above with 1500 in weekly pay the calculation is 1500 x 765. How much tax should I have withheld from my retirement plan.

The federal withholding tax rate an employee owes depends on their income level and filing status. A tax on dividends a tax on net gains from the sale or exchange of a capital asset and a tax on the net taxable income of an unincorporated business are taxes on gain or profit rather for more information on backup withholding see part n in the 2021 general instructions for certain information returns. Medicare tax is withheld at 145 percent. Ad Award Winning US.

9 If this is too muchif you effectively only owe say 15 at tax timethis means youll have to wait until you file your taxes to get that 5 back. The average tax rate for those in the lowest income tax bracket is 106 percent higher than each group between 10000 and 40000. What is the average tax withholding percentage.

Tax Filing Tips For Saving Money On Your Taxes Filing Taxes Free Tax Filing Tax Help

What Is Form W 2 W2 Forms Irs Tax Forms Tax Forms

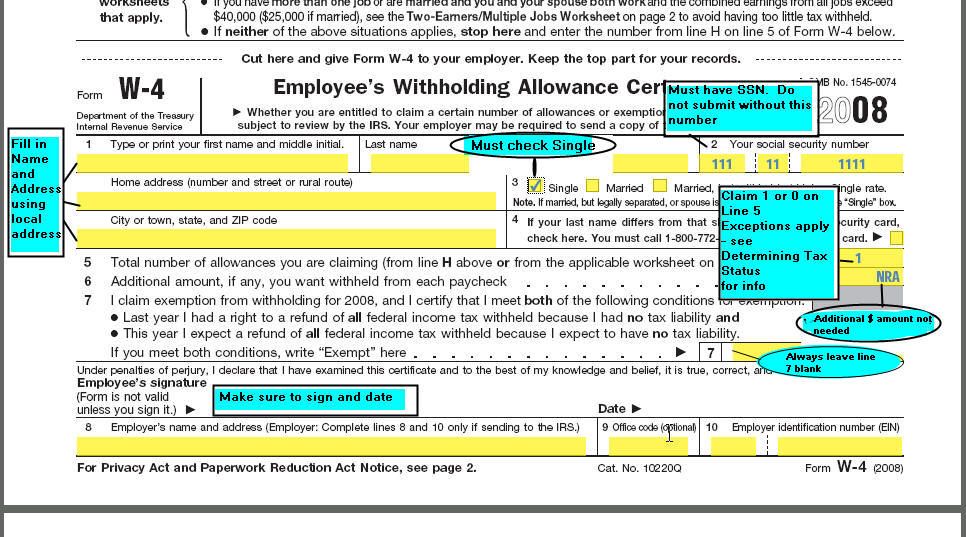

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Tax Refund Proposal Writer

A Visual Representation Of How To Do Your Payroll Taxes Infographic Payroll Taxes Payroll Bookkeeping Business

The Irs Tax Withholding Estimator Irs Taxes Accounting And Finance Irs

Posting Komentar untuk "how much taxes should be withheld"